Staying Put

How big changes in demography are affecting cable subscriber growth

By Stewart Schley

As if cord-cutting, fiber-to-the-home and intensifying 5G competition weren’t enough, the U.S. cable industry is facing another headwind as 2020 rolls out: Fewer people are moving.

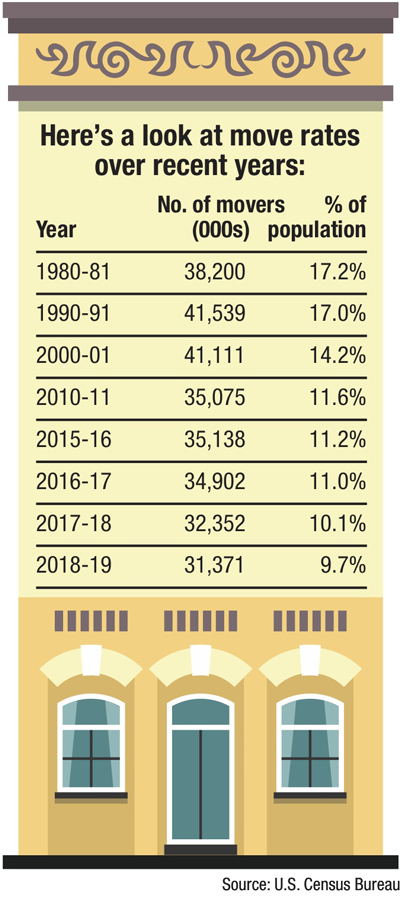

Updated U.S. Census Bureau data tell us that far fewer Americans are changing residences in the course of a 12-month period than we’ve seen at any time during the Post WWII era. Net migration within the U.S. fell to a low of 9.7% of the population for 2018-2019. The roughly 31 million people who did move last year represent a stark falloff from 1990, when 41 million, or nearly one in five Americans, packed up the dishes, booked the moving van and headed off for new climes.

From a sociological perspective alone, the trend lines are fascinating. Why are families now departing from well-established behaviors? Why aren’t we as mobile as we used to be? Why are people staying put?

Researchers think the answers have to do with economic and demographic circumstances. A healthy job climate means fewer workers feel compelled to cross state lines to improve their lot in professional life. On the flip side, housing costs in desirable locales may be off-putting to many. And the general aging of the population has carved into mobility rates, as older Americans tend to be less likely to move.

Implications for cable

If you’re with us so far, you’re probably wondering: What does any of this have to do with my industry?

The answer: a lot. Migration patterns have big implications for market-share battles, subscriber acquisition patterns and net changes in the customer base for everyone from Comcast to DirecTV to Sinclair Broadcast Group’s collective of regional sports networks. When people move — pardon the coarse language — it’s blood in the water for telecommunications providers.

But it cuts both ways. If the family planting a “For Sale” sign in the front yard happens to be a loyal Charter Communications customer with a high-end video package and gigabit Internet, that’s a big hurt on the Charter ledger. But if the departing family is moving away from a suburban home with a DirecTV dish bolted onto the roof, there’s opportunity in the air for wireline cable/broadband providers to swoop in.

Lately, cable appears to have been winning the “mover” wars. Let’s look at 2018. Of the roughly 3.5 million subscribers who defected from the traditional pay-TV category, 2.3 million jumped ship not from a cable company but from direct broadcast satellite: either DirecTV or Dish TV.

We know this because of the net subscriber losses disclosed by parent companies of both providers. DirecTV’s parent AT&T ended 2019 with 1.2 million fewer subscribers than it started with. Dish’s satellite TV service lost 1.1 million. Both are big numbers, and together they add up to a major pain point for DBS. The satellite TV category accounts for about one third of all traditional pay-TV households, but made up fully two-thirds of the net subscriber drain last year. Cable and telco providers also lost video subscriptions, to be sure, but not nearly at the same level.

Of course, not all these DBS defections are tied to moves. Many subscribers stay put in the same home while choosing to cut the cord or to switch video providers. But it’s reasonable to infer that one explanation why DBS is performing worse than cable has to do with the failure to reclaim subscribers who have moved.

Clever tool

One reason cable is a net beneficiary of moving activity has to do with an online mechanism that helps to vacuum up sales leads among these in-play, location-changing consumers.

The smartmove.us website is a tool managed by CTAM, based on the underlying Go2Broadband database maintained by CableLabs.

It’s designed to help customers sign up for telecommunications services in the town or city they’re moving to. What happens is basically an exchange of identities, as the cable company losing the account (let’s say, Comcast) agrees to pass on the lead to the cable company in the new locale (say, Cox). Smartmove.us is the medium for the transfer, with the subscriber’s permission, of course. Along with providing tips on how to ease the stress of moving, it points consumers from Hometown Provider A to Hometown Provider B.

It’s a clever tool, but it’s not immune to broader demographic trends. If, as the Census Bureau tells us, the number of movers is shrinking, that means there are fewer leads to hand over. Last year, for example, there were 5 million fewer people who moved than in 2014-15. That presents an issue not just for cable but for anybody who depends on fluidity in the market to help win share battles. If fewer people are moving, it means there are fewer “free radicals” in the mix to pursue.

To the rescue, however, comes another key demographic influence: new homes. The unsung hero of cable customer growth nationally has always been the formation of new homes in the U.S. Today, the Census Dept. tells us the U.S. is currently on track for a seasonally adjusted annual increase of about 1.3 million homes, against an existing base of around 120 million.

To the rescue, however, comes another key demographic influence: new homes. The unsung hero of cable customer growth nationally has always been the formation of new homes in the U.S. Today, the Census Dept. tells us the U.S. is currently on track for a seasonally adjusted annual increase of about 1.3 million homes, against an existing base of around 120 million.

That’s cause for celebration if you’re a cable company executive, although not at the level you might think. The other determinant here is what percentage of these new homes will be occupied. (It’s hard to sell gigabit Internet to a ghost.) Typically, we can expect to see around 80% of these homes occupied in a 12-month period, meaning we’ve just added around 1 million prospects nationally on behalf of cable, satellite and telco-TV providers.

Of course, the product mix here is fluid. If national trends hold, around 8% of these new occupied homes will shun traditional pay-TV service altogether in favor of over-the-top alternatives (based on Nielsen data). These might include individual accounts to Netflix or Disney+, and/or subscriptions to multichannel online video aggregators like YouTube TV and Sling TV. But the majority of new, occupied homes are likely to sign up for services from a traditional cable, telco or satellite TV provider. And if national trends hold, most of those “gross additions” will go to cable or telcos, not to DBS.

Regardless of who makes the sale, the point is that there’s an enviable supply of new prospects coming to the market thanks to the housing industry, propelled by the underlying engine of population growth. The impact varies by market: Providers like Comcast and Cox Communications are poised to benefit in fast-growing markets like Seattle and Las Vegas, respectively. Others, with concentrations in rust-belt locales, may see the total opportunity erode as fewer (or no) new homes are built, and as people tend to move away in greater frequency.

The “novel approach” here is about taking advantage of fluctuations in the population. CTAM’s tool rakes in thousands of leads each month, parceling them out to cable partners across the country. Combined with net household additions, this behind-the-scenes demographic factor makes for a critical difference as competition heightens for subscribers — whether they’re new to the neighborhood or not.

Stewart Schley,

Stewart Schley,

Media/Telecom Industry Analyst

stewart@stewartschley.com

Stewart has been writing about business subjects for more than 20 years for publications including Multichannel News, CED Magazine and Kagan World Media. He was the founding editor of Cable World magazine; the author of Fast Forward: Video on Demand and the Future of Television; and the co-author of Planet Broadband with Dr. Rouzbeh Yassini. Stewart is a contributing analyst for One Touch Intelligence.

Credit: Shutterstock