Why ‘TV Everywhere’ is Really ‘TV at Home’

By Stewart Schley

The Multiscreen Video Revolution is Gaining Traction at a Familiar Location: Where People Live

The popular descriptor for pay-TV services that extend from the TV set to smartphones and tablets is “TV Everywhere,” a semantic nod to the modern-day portability of what used to be a fixed-location medium. But the name may be slightly deceiving. In truth, wireless video devices are mostly used to watch TV in a familiar place: at home.

A close look at research surrounding the multi-screening viewing environment yields a different viewpoint than what’s sometimes assumed about the TVE revolution. Even over smartphones, the smallest and most portable of video display screens, most of the TV-watching that takes place happens where it has always happened, which is inside the home. The same is true for tablets, laptops, and (by definition) TV-connected video appliances like Roku boxes, Amazon Fire TV dongles and video game consoles. While wireless devices have certainly liberated video from the TV sets that used to be the medium’s exclusive domain, they haven’t, at least yet, provoked a massive migration to out-of-home consumption.

This realization flies in the face of some assumptions and some of the market-positioning of new mobile video services. AT&T, for example, touts its new DirecTV Now live-video service as “TV you can take anywhere,” suggesting visions of fixated subscribers catching NFL games at the beach or watching Fox News live at the train station. Cable companies also are determined to support out-of-home viewing experiences. Comcast has recently made big strides in replicating much of the channel lineup it delivers to subscribers for outside-the-home viewing, including a nifty download-to-watch functionality.

These are important extensions to familiar cable-like video services, to be sure. But they’re actually playing to a smallish segment of the total viewing environment, the bulk of which remains squarely fixed inside the home.

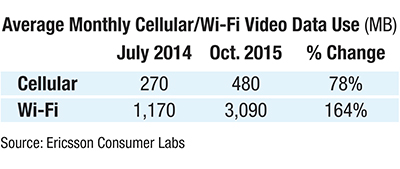

A data traffic analysis published in December 2016 by the mobile communications technology company Ericsson helps clarify what’s happening. After analyzing traffic delivery associated with smartphones, Ericsson found much more video viewing over smartphone screens is happening on Wi-Fi networks, which are (mostly) associated with in-home data consumption, than over cellular networks, which tend to be used outside the home. Here are the numbers:

Ericsson’s findings don’t suggest access to video over cellular networks is diminishing; in fact, as the data shows, it’s growing. But the greater momentum by far is toward indoor and at-home use of Wi-Fi networks to render video on portable screens. “With a lot of mobile device viewing time spent indoors, it should come as no surprise that over 85 percent of data traffic generated by the use of smartphone video apps goes over Wi-Fi,” Ericsson pointed out.

There also appears to be rising momentum for using smartphones in general to watch video in the home, especially among younger users. Ericsson found teens — the most prolific watchers of video on smartphones — increased their at-home video viewing on smartphones by 85 percent from 2011 to 2015 (possibly to the great chagrin of their parents).

The key phrase here is “at home:” Keep in mind what Ericsson is tracking is a relatively new phenomenon whereby kids are still watching lots of television at home, except they’re watching it on a different sort of screen.

Deep dive

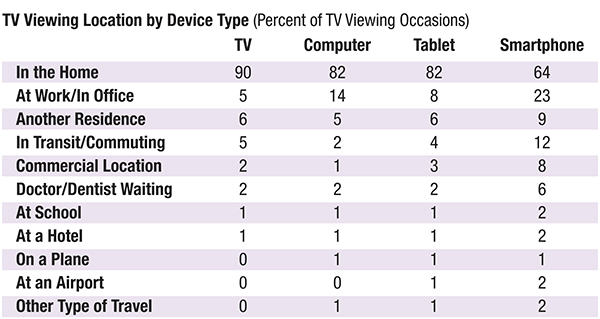

The authoritative research pertaining to this subject traces back to 2013, when an intra-industry coalition, the Council for Research Excellence, engaged researcher Chadwick Martin Bailey to conduct a survey of 6,000 respondents, an unusually large sample. The CRE initiative left little doubt about the location of choice for video viewing on portable devices: 82 percent of tablet video sessions, and 64 percent of smartphone video sessions, took place inside the home. But the appetite for at-home viewing is even more apparent when you consider a secondary statistic: Of the 36 percent of smartphone video sessions that did take place outside a user’s residence, one fourth of them (or 9 percent overall) happened in a home — it just happened to be a home that belonged to somebody else.

The watch-at-home tendency is also supported by a 2015 global survey of 4,800 persons conducted for the Interactive Advertising Bureau by researcher On Device Research. In the U.S. and Canada, 95 percent of mobile video users said they watched content at home, versus 55 percent who watched occasionally outside the home. Similar ratios held up outside North America. “Across all regions and markets we studied, mobile video viewing occurs primarily at home,” the group’s report states.

Why it matters

The question that’s always worth asking about research is: So what?

In this case, there are manifold implications with relevance for cable companies. Here are a few:

- Technology Transformation. One of the more obvious implications has to do with provisioning for network capacity. We already know video is rapidly engulfing the Internet: Cisco’s much-quoted Visual Networking Index projects video will make up 82 percent all Internet traffic by 2020. The cable industry’s embrace of next-generation delivery technologies like DOCSIS®1 and fiber-to-the-home (or near it) architectures is designed in part to accommodate the skyrocketing demand for video over IP. But the insights about in-home video usage habits remind us that network agility mustn’t stop at the home gateway or the modem. Beyond the demarcation point, in-home wireless networks must be able to keep up with demand pattern for slinging video across almost any location inside the home. Wi-Fi networks inside the home increasingly have more video to serve, more devices to serve it to and, interestingly, a wider footprint to cover. A new CableLabs initiative, for instance, aims to help operators provision multiple Wi-Fi access points in order to accommodate an increase in new-home sizes, which are on average 60 percent larger than in 1973, according to the U.S. Census Bureau.

- Recasting the Message. On the technology-meets-humanity front, cable companies need to recognize the TVE revolution is mostly an inside-the-home phenomenon. You can see this starting to happen in some of the marketing/messaging from the industry. Comcast’s late-2016 marketing campaign built around the theme of “separate togetherness” is a fascinating example. The signature television commercial from the campaign depicts members of a family, together at the same time inside a home (and in the backyard), watching television independent of one another on tablets, smartphones and a TV set. This motif plays to the realization that the multi-screen video revolution is mostly happening at home, not outside of it. “They’re in their home together, but they’re having separate viewing experiences,” Comcast senior director of TV Everywhere Vito Forlenza explained at last year’s INTX conference in Boston.

- Rethinking the Economics. Overarching industry economics also are affected, but perhaps not in the way everybody once believed. TVE may turn out to be less of an extension of the industry’s economics than once thought. The idea that users would carry smartphones out into the world to catch their favorite TV shows seemed to be the stuff of a business strategist’s dreams — an idealized setting for adding incremental audience exposure that could be monetized through dedicated advertisements and the impressions they attract. “Because smartphones can be used out of the home, this creates ‘new windows of time’ for content viewing,” enthused the investment research firm Needham & Co. in a September 2016 analysis. But if people are using alternative screens mainly to watch the same television content in the same locale where they always have, it may cut short the opportunity — or at least redefine it. Ultimately, TVE may come to produce an extension of viewing durations more so than viewing locales.

In a broad sense, it’s not surprising most TV viewing would happen in the home despite the new dexterity wrought by the smartphone video revolution. After all, most people spend most of their leisure time at home, where (in the U.S. at least) multiple video devices and robust network connectivity are common. Close to 87 percent of U.S. adults now own a smartphone (Nielsen), more than 80 percent of homes have broadband and 65 percent have at least one TV set connected to the Internet (Leichtman Research). In this device-rich, connectivity-rich environment, it’s true that the TV picture is changing, with more people — and teens especially — choosing screens other than the television to watch. But suggesting that Americans are flocking to out-of-home viewing misstates the reality. The “Everywhere” in TVE is more about a multiplicity of serviceable screens than it is a physical or location transformation for television. For television in general, even in the mobile communications era, there’s still no place like home.

Stewart Schley,

Stewart Schley,

Media/Telecom Industry Analyst

stewart@stewartschley.com

Stewart has been writing about business subjects for more than 20 years for publications including Multichannel News, CED Magazine and Kagan World Media. He was the founding editor of Cable World magazine; the author of Fast Forward: Video on Demand and the Future of Television; and the co-author of Planet Broadband with Dr. Rouzbeh Yassini. Stewart is a contributing analyst for One Touch Intelligence.

Source: Ericsson Consumer Labs

Source: Council for Research Excellence, June 2013

Credit: Shutterstock