All Boxed Up

By Stewart Schley

In November of last year, word leaked about an interesting initiative that’s in the works at Comcast: a new set-top box.

But not just any set-top box. This one, according to a CNBC report, is a sibling to Comcast’s X1 that’s designed to attach to Comcast’s broadband data network on one side, and a TV set (plus a slew of home-automation gear) on the other.

The target for the new device: cord cutters, shavers, nevers and general resistors. These are the people who shun traditional bundled pay-TV video services, including the type that flow over Comcast’s X1 digital video platform. Instead, they’re perfectly happy to rely on newer “over-the-top” or “OTT” video offerings that travel across the public Internet and wind up on various glass screens, TV sets included.

If this mystery box looks/sounds familiar, that’s because it is. You might recognize it in the guise of branded OTT video receivers that go by names like Roku, Apple TV and Fire TV. Along with Google’s Chromecast family of TV dongles, these Big 4 OTT video box makers command the majority share of an emerging market that’s growing fast.

Fast enough, in fact, to suggest a reckoning is at hand.

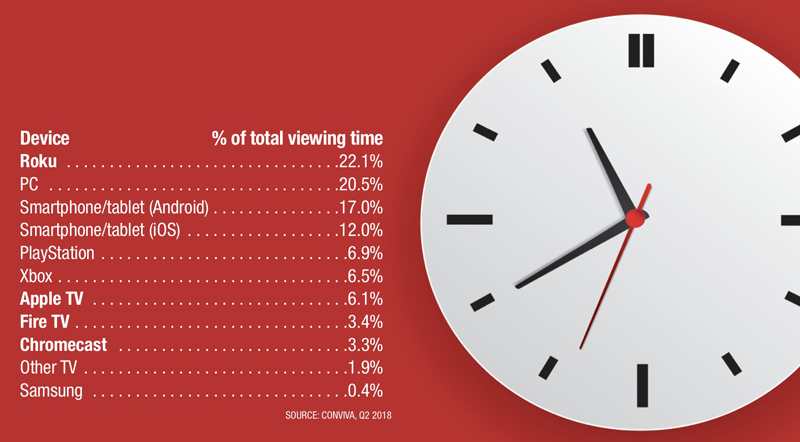

Because while you weren’t looking, these newfangled boxes were infiltrating America’s living rooms in a big way. Leichtman Research Group estimates 46% of U.S. homes now have one or more self-standing “connected TV” devices in use. Roku and Amazon are neck-and-neck for the top spot, according to some recent surveys, with Apple and Google also well-penetrated (see DataPoints, p. 56). In terms of streaming hours, the box group holds its own with well-worn platforms including PCs and smartphones, according to an analysis of more than 5 billion streaming hours conducted by measurement specialist Conviva. Roku topped the Conviva list, contributing more viewing hours than computers and video game consoles.

Questions, questions

As always, we like to ask two fundamental questions around fresh data points and marketplace shifts:

- Compared to what?

- Why now?

First, the “compared to what” question. How about compared to traditional set-tops? One of the more provocative statistics to emerge recently about the pay-TV category is that there are more OTT video boxes (like the puck-sized Apple TV) in U.S. homes today than there are…drum roll…cable set-top boxes. Leichtman Research says the average number of connected TV devices in use across U.S. TV households has risen to 2.8. The average number of traditional cable/satellite TV set-tops: 1.7. So even granting a sliver of statistical sampling error, it’s pretty clear the way video signals get to TV sets (and particularly to second and third TV sets within a home) has shifted.

As for the “why now” question, it’s also evident that shifts in video consumption are forcing reflection within the cable industry. The size of the consumer OTT video sector is now too big to be dismissed as a fringe movement.

Nielsen added some perspective in January when it released an updated estimate of the share of U.S. homes that rely either purely on over-the-air TV, or combinations of over-the-air TV and OTT video, to satisfy their video appetite.

As of Q4 2018, 14 percent of U.S. homes fell into this category — a rise of 48 percent over eight years. Another 4-5 percent use only OTT video without any sort of OTA reception. Taken together, the numbers mean penetration of traditional pay-TV (cable, satellite TV and otherwise) has sunk to around 78 percent, the lowest level since the late 1990s. Cable companies, whose video economics depend on assumptions of lofty penetration levels, can no longer ignore the growth and size of the non-traditional video category.

One solution, and probably a smart solution, is an “if you can’t beat ’em, join ’em” strategy that gives cable providers a mechanism for drafting behind the growth trajectory. Thus, Comcast (and we anticipate, others) will increasingly look to satisfy a changing video appetite where OTT video plays the lead role.

But where’s the profit?

Which brings us back to the box. Producing an OTT video receiver platform will vault Comcast into a category that’s fiercely competitive and margin-challenging. Roku, whose line of OTT video receivers, dongles and TV operating system software has become a household name, reported a gross profit margin of just 11% from hardware sales in its latest quarter, contributing to a net loss for the period of $11.7 million. It’s not hard to see why: The critically praised Roku Premiere 4K streaming device costs $29.

Why then, are companies like Roku and Amazon in the mix at all? Partly because each of the Big 4 OTT box makers has ambitions to do more than peddle devices.

Google owns the dominant platform for ad-supported OTT video, YouTube, and its YouTube TV live/linear streaming offshoot. Amazon is the power behind Amazon Prime video, and Amazon’s Fire TV is the only device family (aside from personal computers) that enables streaming of Amazon’s new IMDB FreeDive video service. If you have a Roku, you can’t watch it.

There’s more. Apple is about to storm the world with a high-end original video service, backed by $1 billion in original content investment, that we suspect will play over Apple TVs, iPhones and other in-the-family devices — and nowhere else. And Roku has made no secret that its end-game business is about selling advertising inventory within channels like its own Roku Channel (which is accessible over the nearly 24 million Roku devices active in homes today).

The idea is that he/she who controls the living-room hardware has a big influence in what gets watched, talked about and monetized. We suspect that in the future, a nonchalant query to Amazon’s Alexa assistant (who happens to live inside Fire TV boxes) about “what’s good tonight on TV?” is unlikely to yield an enthusiastic endorsement of YouTube’s newest episode of “Cobra Kai” or the new Reese Witherspoon comedy funded by Apple. Instead, Amazon’s “The Marvelous Mrs. Maisel” might get the nod. Viewers are all but drowning in TV choice today; boxes and their accompanying interfaces are there not just to enable it, but to manipulate it.

So, if boxes yield engagement and all the good things that go along with it (more subscriptions, bigger audiences, reduced churn, improved loyalty) then why should cable companies yield the stage to outsiders?

They probably shouldn’t. And they probably won’t. Comcast’s work on a house-brand OTT video device may be the tip of the set-top iceberg here; a harbinger of a shift to serve a smaller but growing part of the video subscription base.

X1 is a marvelous contraption that even competitors admire. “It’s fantastic,” enthused Fast Company in a 2018 article. But as good as it may be, it’s not for everyone. The nation’s largest cableco recognizes that fact, and has dispatched a team of engineers to come up with the kid brother that just might grow up to redefine video in a changing environment. Now that’s thinking outside the box.

Stewart Schley,

Stewart Schley,

Media/Telecom Industry Analyst

Stewart has been writing about business subjects for more than 20 years for publications including Multichannel News, CED Magazine and Kagan World Media. He was the founding editor of Cable World magazine; the author of Fast Forward: Video on Demand and the Future of Television; and the co-author of Planet Broadband with Dr. Rouzbeh Yassini. Stewart is a contributing analyst for One Touch Intelligence.

credit: Shutterstock.com