Telecom for Wellness

By Dr. Sudheer Dharanikota and Clark Stevens

Architecture and use cases

In the previous installment of our Broadband Library article [1] we explained the Telecom for Wellness (T4W) opportunity for cable operators. In this second article, we discuss the architecture we propose based on the team’s three+ years of research and discussions (as explained in detail in the published SCTE report [2]), and the high-level use cases that consolidate the architectural components. In the this article, we explain some of the solutions and how to get paid for these deployments, and in the final article, we will present the conclusions and next steps for cable operators.

The wellness industry is going through a major transformation to modernize the infrastructure, reduce the cost and increase the quality of care. We call this inter-industry collaboration T4W. Even though the T4W opportunity is not limited to these two major intersection points, we focus on Aging in Place (AIP) and Telehealth use cases to illustrate our thoughts on the end-to-end T4W architecture in [3]. (Refer to [4] for six different opportunities that a telecom operator can address through the T4W architecture covered in this article.)

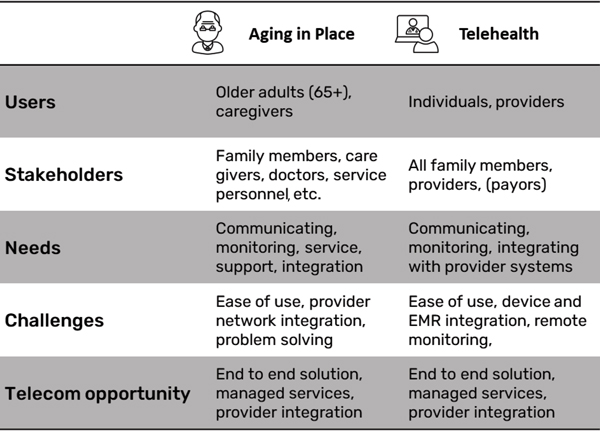

Figure 1. T4W opportunity and challenges summary.

Figure 1 provides a quick summary of the T4W opportunity and challenges from AIP and Telehealth points of view. Many of the needs, challenges, and telecom opportunities of both markets are similar (refer to the SCTE working group analysis in [5], [6]). Some of the high-level use cases that need to be supported for these two markets include:

- Providing basic communication between the users and the providers/caregivers

- Providing seamless communication between the users and the stakeholders

- Monitoring the users for health, mobility, fall detection, etc.

- Analyzing the data collected from the users and properly notifying the stakeholders.

- Assisting the T4W service providers with claims by documenting accountability

- Offering managed services to support installations, product support, and other services to improve adoption and retain customers.

Many of these use cases are elaborated in [4]. In this article we present AIP, independent living, and hospital at-home use cases (the extreme ends of T4W) with the consideration on what are the opportunities for the cable operators.

T4W architecture

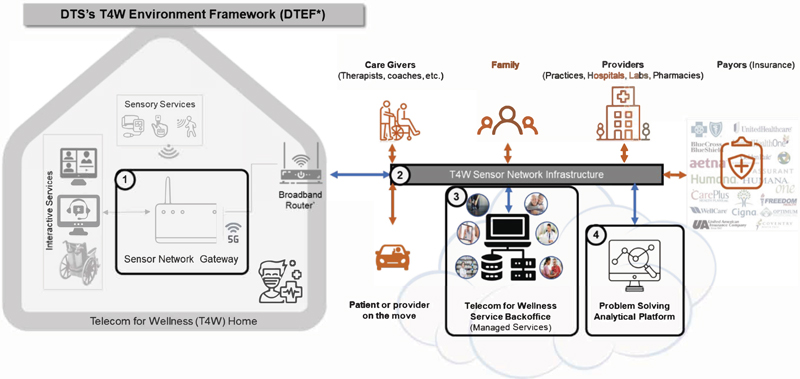

Figure 2. End-to-end Telecom for Wellness architecture.

Figure 2 provides a high-level end-to-end architecture proposed by Duke Tech Solutions (DTS) in their market analysis [7] based on different T4W market opportunities. The framework is elaborated in [3].

To understand the end-to-end T4W architecture, first, we need to understand the users, the service providers, and the other stakeholders as shown in Figure 1. We adopt the architectural framework provided in [3], DTS’s Telecom for Wellness Environment Framework (DTEF), to evaluate the analytical framework components proposed in this article. We will use AIP and Telehealth use cases to do this.

- In-home healthcare/wellness aware gateway: From use cases A, B, and C, there needs to be a gateway in the T4W home. This gateway, as shown in Figure 2, acts as an integration point for monitoring the sensor devices (e.g., motion sensors, remote patient monitoring equipment) and integrating with the interactive services endpoints (such as unified communication services). This sensor network gateway (SNG) can be a standalone device or integrated with other vendor equipment such as the set-top box or residential gateway.

- T4W aware network infrastructure: Again, from the use cases A, B, and C the T4W requires connections between the users, the providers, and the other stakeholders. This requires not only reusing the existing telecom infrastructure but will also need to meet reliability, security, and privacy requirements specified by the T4W architecture. The communications infrastructure will have to meet the needs of the sensor network traffic, unified communications traffic, and notifications to the different stakeholders. To differentiate (or to keep the focus on) the T4W needs, we call this the T4W sensor network infrastructure.

- T4W aware service back office: Cable operators have all the required infrastructure for managing end-to-end services. As mentioned in use case F, it is essential to turn the fragmented, gadget-oriented point solutions into a well-oiled managed service. This can only be accomplished by telecom operators who have access to such infrastructure and have been managing communications infrastructure for 90+% of the households in the U.S. We call such infrastructure T4W service backoffice.

- T4W aware problem-solving analytical platform: Finally, as mentioned in use cases D and E, this infrastructure attempts to solve the problems stakeholders are facing. These problems and related algorithms may be unique to the healthcare/wellness industry, but the infrastructure is like the infrastructure the telecom operators use today. We call this repurposed analytical platform the T4W problem solving analytical platform.

T4W use cases

Use cases in wellness care are as unique as the patients themselves, so flexibility is very important. However, there are some key categories of service that are common across most use cases. The following are some of the use cases.

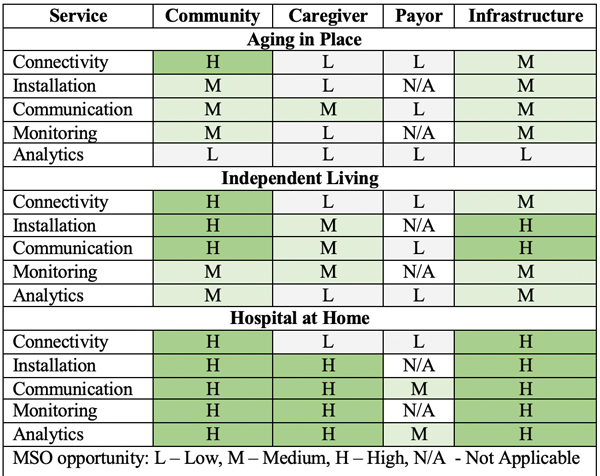

Aging in Place, which involves passive monitoring with selective assistance for daily tasks. The best AIP technologies do little or nothing to disrupt a patient’s normal activities. For example, a connected pillbox can report which medications a patient takes and when. Falls can be detected by a watch or other worn item or passively detected by a floor-mounted impact sensor. The point is to provide technical tools and assistance to help the patient do simply what might otherwise be difficult. The table in Figure 3 maps several services that might be required for a patient aging-in-place mapped against the various stakeholders who might be involved in delivering that service with the opportunity of cable operators in mind. The in-home architecture illustrated in Figure 2 outlines an infrastructure that can provide these services. The data network in the home connects all the relevant devices. It also allows for remote communication with the patient’s community and healthcare providers. Information from the sensors can be logged and analyzed and can be shared during remote visits. All this information travels over the network protected by the highest reasonable data and transport security levels. The status of each connected device can be monitored with deviations from expected norms reported. Defective equipment can not only be detected but proactively determined for immediate service or replacement.

The next level of use case is independent living. In this circumstance, patients are not able to do some daily living activities without assistance. Patients may have mobility issues around the home, or they may have cognitive impairments that require personal assistance. It may be important to have professional home visits scheduled and audio or other reminders provided. Physical access to the home may need to be controlled through a video camera interface and verified credentials. Automated locks can secure the home but allow access for verified visitors. The table in Figure 3 illustrates some of the differences between aging-in-place and independent-living patients. Some of the stakeholder roles may be different, but they fall into the same general categories. Independent living still requires connectivity, infrastructure, and security. While aging-in-place can get away with mostly passive monitoring, assisted-living use cases may require more direct monitoring.

Figure 3. T4W opportunity analysis for cable operators.

At the end of the spectrum is the hospital-at-home use case. In this instance, acute care is needed. The patient may be bedridden or otherwise mobility limited. Maybe complicated procedures need to be regularly performed. If constant in-person professional monitoring is not required, though, the patient will often prefer in-home care where they can be in familiar surroundings and with family more frequently. This alternative, when possible, also drastically reduces provider costs. Assistance with meal preparation and personal hygiene may be required. The table in Figure 3 shows how hospital-at-home services differ from aging-in-place or independent living use cases. Again, the technical infrastructure is the same. Just the level of service is increased.

What can telecom operators offer?

Now let’s look in a little more detail at the technical service categories required by patients in these various use cases.

Secure Connectivity: At the most basic level, any sort of in-home care requires a secure, reliable network. This is already the core service that cable operators provide to homes. What is new is the extension of networking to devices within the home. Operators are already investing into such solutions such as managed Wi-Fi. Hence this would be an extension of such services.

Accessible Communications: Beyond the basic network, applications will be required for communication. This will include video conferencing to communicate with the community and with caregivers. During COVID, many people became quite familiar with this technology. Commoditizing such a solution for the elderly is essential here. For example, users may find it easier and more convenient to do video conferencing on a television from their couch. Communications will also need to extend beyond video conferencing. During medical visits, it may be important to share output from devices like networked blood pressure cuffs or pulse oximeters. This information becomes even more useful if it has been logged over time with significant readings/events highlighted and commented. A video conference may be initiated by sensors noting events that need to be evaluated by medical professionals. An important part of this communication network is the notification infrastructure. In certain cases, a caregiver, doctor, or nurse may need to be notified that conditions have exceeded a certain threshold.

Monitoring: Connecting equipment to a secure network enables remote monitoring. On a basic level, this can be door and motion sensors that record when the patient uses the bathroom. Other instruments may monitor sleep conditions or measure parameters from more involved medical instruments. Authorized caregivers or family might be alerted to a fall or failure to take medications. Data can be securely logged so the circumstances of any event can be placed in context even after it occurs.

Analytics: Collecting accurate time-stamped data is critically important, but often isolated data yields little insight. Predictive and proactive analytics must take information from all sources, look at it in context and extract the important information. Big data analytics techniques can evaluate massive amounts of unstructured data and determine correlations that might be impossible for humans to discover. More information with better insights obtained more immediately at a lower cost means more efficient healthcare and better care for the patient.

Cable operator solutions

COVID forced many people to utilize remote wellness much sooner than they might have done otherwise. While remote doctor appointments are just one feature of home health care, they introduced people to the concept. This enabled broadband providers with a slew of opportunities such as the following.

Integration: From the start of the cable industry, cable providers have been involved in integrating and packaging services for simpler consumer consumption. Cable providers collect content from several services and sell it as a single service to consumers. The idea of aggregating wellness services from several stakeholders into a single home service is a natural evolution. The networks that connect stakeholders are provided by cable operators with billing, operations, installation, management, customer service, and other cable skills critical for a successful home wellness care service.

Connectivity Provider: Connectivity is a primary cable product. Cable operators are premium providers of networking services for consumers and businesses. A secure network is a basic infrastructure required for any home wellness care service. Customers already trust this service and are comfortable paying for it every month. Regardless of who provides home healthcare, there is a good chance based on home service penetrations that cable networks underly that service. It is not much of a stretch to think that cable operators can create a viable and secure home healthcare service.

Installation Services: Cable operators have fleets of service vehicles and trained installers who regularly install equipment in customer homes. There are few industries more capable of installing networked residential devices. Given the wellness requirements, additional training and certification will be required for technicians with this responsibility, but several business models could be used to manage qualified technicians.

Monitoring Services: Monitoring equipment is necessary to keep the network running optimally. Remote monitoring is required to do this at scale. For cable operators, this is business as usual. Extending this service to wellness equipment in the home will require expansion, but it is expanding an existing service rather than introducing a new one. Data collected from equipment can be used to diagnose both individual hardware devices and the network in general. A wellness portfolio would require many more data models, increased storage capacity, and an improved analytics capability.

Analytics: Analytics involves making sense of data. The cable industry has tremendous storage and computational resources capable of performing these complex analytics. Where cable companies don’t own the technical and human resources outright, they can get these services through many cloud service providers. Refer to some of the extensions for T4W to the existing analytical platforms in [8].

What next

In the next installment, Sudheer Dharanikota and Charles Cheevers will elaborate on some of the solutions that are available for the operators and how to monetize them. For additional information reach out to the authors.

References

[1] Chris Bastian, Sudheer Dharanikota, Telecom for Wellness – A business case for cable operators, Broadband Library, Summer 2023

[2] Cable Operator’s Aging in Place and Telehealth Opportunity Analysis, SCTE Standard, SCTE 284 2023

[3] Sudheer Dharanikota, Clarke Stevens, End to End Telecom for Healthcare Architecture – A Cable Industry Perspective, SCTE Expo, 2021

[4] Clarke Stevens, Sudheer Dharanikota, Aging in Place and Telehealth Use Cases from the Cable Operator Perspective, SCTE Journal, March 2022

[5] Data Standards Subcommittee, Working Group 3, Aging in Place

[6] Data Standards Subcommittee, Working Group 4, Telemedicine

[7] Duke Tech Solutions market Research, Telehealth market report – A Telecom-based opportunity analysis, available here

[8] Sudheer Dharanikota, Clark Stevens, An analytical framework for solving Telecom for Wellness problems, SCTE Journal, January 2023

Dr. Sudheer Dharanikota,

Sudheer has more than 25 years of experience in the telecom industry as a strategist, product line manager, architect, development lead, and standards contributor. He is known for his strategic, technological, and product execution activities in access network technologies and services.

Clarke Stevens

Clarke Stevens

Throughout his career, Clarke Stevens has worked in engineering, research, product management and strategy for digital media and communications at CableLabs, MediaOne, SonicBlue, Qwest and most recently as principal architect of emerging technologies at Shaw Communications.

Figures provided by authors

Shutterstock