The Bridge to FTTH Runs Through Cable — and Many Roads in Between

By Juan Bravo, Antronix (Sponsored)

There’s a little irony in the fact that now it seems more than ever, cable operators are seriously seeking ways to make the most of their extensive legacy HFC infrastructure, even as they move more assertively to drive fiber deeper. The last two years have brought some things into starker relief — for one, the need to accelerate fiber deployments while also seeking effective and viable solutions that make the most of the vast coaxial RF infrastructure built by cable over decades. Beyond the outside plant and access architecture, there is also tremendous value in solutions that continue to leverage the existing back office infrastructure and hub equipment, while enabling new signal architectures and transmission platforms that can eventually evolve into final stages of hybrid or all fiber networks capable of multi-gigabit symmetrical data rates and virtually infinite scale. Antronix has been focused intently on this challenge for quite some time now. We celebrated our 40th year during the pandemic and are as intent as ever on continuing to deliver real solutions for our customers who have their top and bottom lines in mind.

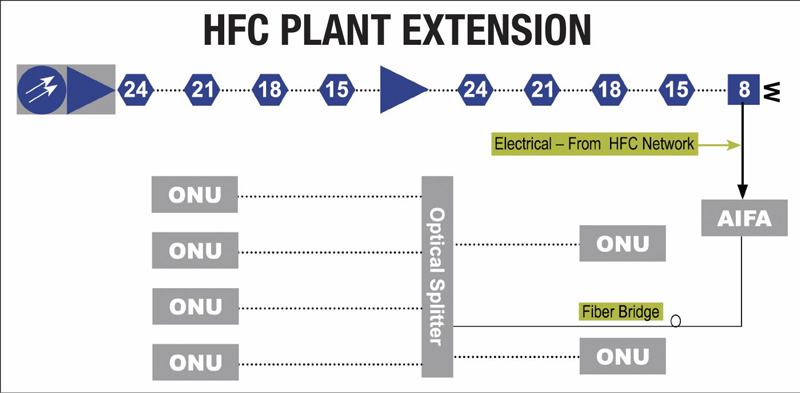

The Antronix AIFA is a solution designed expressly for that purpose. Used as a bridge between the existing HFC plant and remote FTTH deployments, the Antronix Inverse Fiber Amplifier, AIFA, is an design capable of extending the HFC network to small, rural clusters of potential FTTH subscribers, without the need to run fiber directly form the hub or headend to these remote locations where such a run would be cost prohibitive. The AIFA allows operators to convert their RF to optical at any point in the HFC node or tap cascade, even the most remote reaches of larger service groups, and extend the optical network by up to 10 km. This capability allows for the circumvention of a dedicated, direct fiber run from the hub or headend, reducing substantially the cost of deployment and time to market for FTTH builds. From an investment, time to market and field operations perspective, for small clusters of remote subscribers, an HFC plant extension utilizing the AIFA is more desirable than either a conventional FTTN, direct run FTTH build from the headend or hub, or a PON overlay.

Utilizing an approach that continues to leverage existing gray optics and analog infrastructure has distinct near-term advantages when considered as part of a longer-term migration path to Ethernet transport, either towards a node+0 R-PHY architecture or an PON FTTH scenario.

Operators are then able to significantly improve their ROI for fiber deployments, while leaving in place a valuable last leg infrastructure which can eventually be augmented at the back end when moving to a more comprehensive all fiber architecture. This approach is also more aligned with existing field services operations, the skill set of plant technicians, and the overall fluency of their workforce, resulting in a more reliable and cost effective operation which can also deliver on niche services for FTTx and top tier gigabit data.

Not all Inverse Fiber Amplifiers or Extenders are created equal, however. The Antronix AIFA design is built with superior componentry for comparably improved reach, reliability and performance. A low chirp direct modulated 1.2 GHz forward 1550 nm, 9 dBm transmitter delivers excellent and consistent field performance in a highly intuitive package that translates into improved time to market and ROI for previously challenged rural or semi-rural areas. The return receiver is a high sensitivity ( -14 dBm minimum input) with a high output of +45 dBmV/channel. The superior quality of both the forward and return design provides best in the industry field performance in analog, SC-QAM, or OFDM loading or any combination thereof, making it highly versatile and reliable in a wide array of plant conditions.

The solution is completely agnostic and easily deployed.

This architectural approach allows for a moderated and incremental investment in a fiber deeper infrastructure, while producing nearer term returns and better correlation with new revenue opportunities. A fiber bridge AIFA deployment is far less front loaded than a PON overlay, for example, and can decrease the required investment in an all fiber FTTH, FTTx, FTTB by up to 30% for a typical use case. Importantly, a conversion to IP can be deferred until the existing CPE investment has been fully realized.

Higher output variations of the fiber bridge, which incorporate an EDFA and OBI mitigation can be highly effective for even larger service groups that may still fall short of viability in a more conventional FTTH or node+0 scenario.

As the transition to an all fiber PON becomes more economically viable, the fiber link at the back end of the network can be augmented on a measured schedule that yields better returns for the operator in the long run. Remote OLT cabinets can replace optimally located legacy nodes or RPDs with embedded OLTs or PON pass-thru designs which can then begin to supplement the existing HFC plant components consistent with a more traditional FTTH architecture. The result can deliver a well-orchestrated and incremental migration path to an end stage all passive PON architecture that is capable of 10, 25 or even 40 Gbps PON without further changes to the cable access infrastructure.

But that eventuality, and the real demand that would justify such a significant investment in the medium term, operators would probably agree, is still very unpredictable and the timeframe is uncertain — the recent trend in data usage due to the pandemic would suggest an acceleration of that trend, but that seems to have plateaued, and cable operators generally feel it seems that while new investments in infrastructure should be accelerated, they have fared pretty well through the pandemic surge in data demand and higher contention, while also exposing some real vulnerabilities in upstream capacity which they are very actively addressing. Options to make incremental investments rather than front load the expense on a wide scale, are always a welcome option — and hinge firstly on innovative technology.

The AIFA is just one example of how Antronix is working every day to make the most of the vast cable infrastructure operators still rely on so heavily for the majority of their networks, and how we are innovating to offer operators every viable option to deliver on their objectives with the most cost effective designs.

DOCSIS 4.0 and FDX will also provide a viable path to extending the viability of HFC for a long while to come. And there are many other possibilities. Our eHFC solution will allow operators to deliver PON performance over their drop infrastructure. Using data aggregation and a highly tolerant ultra-wide band modulation scheme in an FTTT (fiber to the tap) optimized design, operators will be able to continue to benefit from all the capacity upgrades of their DOCSIS network, while aggregating PON in a fully interoperable platform that can scale to support 100% contention and symmetrical rates at gigabit speeds.

Taken together with our MHT 2.0 GHz tap platform, and our Extended Spectrum Milenium G6 retrofit taps, we’ve developed a roadmap that strives to offer the most valuable solutions for this critical journey.

Not all networks will have the same need at any given point in time, and there are many roads to this exciting future in broadband services.

Juan Bravo,

Vice President, Sales,

Antronix

Juan Bravo is vice president of sales at Antronix. He leads the company’s national sales and new market initiatives, and shares responsibility for product innovation and business development. He is instrumental in advancing the creation of new products to meet the changing needs of customers. Juan has worked in the cable industry for more than 20 years in sales, business development, and marketing. He holds several patents.

sales@antronix.com • www.antronix.com

Antronix (Advertorial)