Telecom for Wellness

By Chris Bastian and Dr. Sudheer Dharanikota

A business case for cable operators

What is the need?

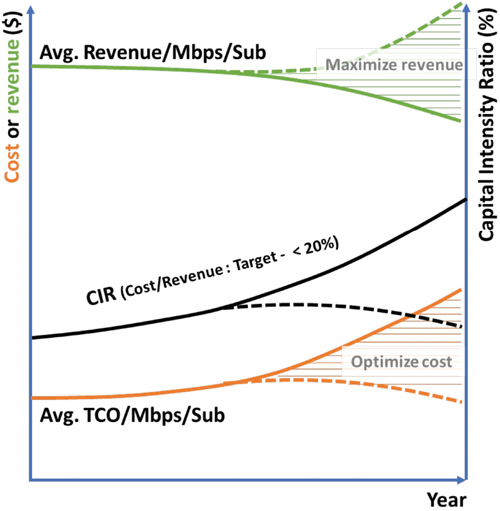

Telecom operators are under constant pressure to keep their capital intensity ratio (CIR) – CapEx/revenue – under 20%. This is next to impossible with the current growth in bandwidth demand, increasing costs of access transformations, and constant pressure on revenues (refer to [1], [2]). As shown in Figure 1, to maintain CIR at 20%, operators need to optimize their transformation costs (not in the scope of this discussion, refer to [3]), and increase revenue through value-added services. This article focuses on one such lucrative inter-industry opportunity, “Telecom for Wellness.” In this first of a series of articles, we highlight a business opportunity and introduce the work we are doing in SCTE DSS Working Groups 3 [4] and 4 [5].

What is Telecom for Wellness?

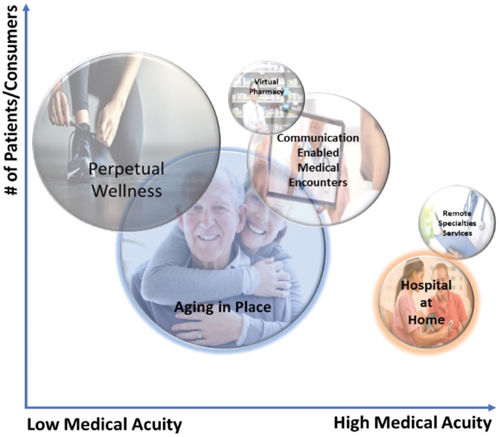

US healthcare costs are increasing at 5.4% year over year and are estimated to reach $5.5 trillion by 2026. The US healthcare industry is huge, and policymakers have been concerned by its spending growth relative to total gross domestic product (GDP). The criticism is sometimes characterized by the idea that the US healthcare system is a sick-care system and that boundaries must be broadened to effect positive change in national healthcare. Wellness and social determinants of health are important items for discussion within the healthcare industry. To encompass the right opportunities for telecom operators we have focused on wellness as opposed to the narrow opportunity of healthcare alone. As shown in Figure 2, the size of the wellness opportunities encompasses the active life, living conditions, medical conditions, etc., of the individuals. For a detailed discussion of these opportunities and their size, refer to [6]. These opportunities range from low to high medical acuity. This represents an interesting opportunity for cable telecommunication operators with a strong residential and business franchise presence. We call these inter-industry collaborations the Telecom for Wellness (T4W) opportunity.

Figure 1. The need for value-added bandwidth pipes.

The caregiving industry has been modernizing its infrastructure intending to control costs and improve the quality of care. Telehealth is one such mechanism that has been gaining adoption. Telehealth played a critical role in virtualizing care during the COVID pandemic. Telehealth has been growing at a yearly rate of ~15% with 2020 seeing a 175x increase in telehealth adoption mainly due to COVID-19. Telehealth is not just video communications, but it also touches on different technological solutions that cable operators have mastered and have been deploying. Healthcare is a small part of the wellness industry. To properly focus on the needs and operator capability mapping, in the remainder of this article we address the wellness industry.

The wellness industry has lagged behind most industries regarding the virtualization of services. Consider how the retail, finance, and entertainment industries have been transformed by digital technology over the last decade. The potential disruption to wellness is inevitable. The cable industry brings technology and leadership in building standards-based platforms that can deliver critical cost reductions required to assist the wellness industry.

Also, cable operators are underutilizing their capabilities – namely customer relations, the end-to-end infrastructure, the service infrastructure, etc. How can an operator create a win-win opportunity by playing to their strengths? It is logical for the operator to evolve from their current basic bandwidth selling to offering high-valued services to inter-industry verticals. T4W opportunities such as Aging in Place (AIP) and Telehealth are two such examples, as we have analyzed in detail in a ~200-page technical report [7]. In [7] we analyze different services which are driving caregiving costs that can be addressed by these T4W initiatives. These services include AIP and telehealth services. Telehealth and AIP present exciting opportunities for cable and fiber operators to offer new products and add value to existing services. Such opportunities, if executed with conviction, will add higher margin opportunities to operator portfolios, reinvigorate the workforce, and reuse the existing infrastructure to its next level.

Figure 2. Telecom for wellness opportunities.

- The lower the medical acuity in the figure, the lesser the interaction with the healthcare professionals.

- Telehealth is defined as the use of telecommunication technology to provide healthcare services to anyone regardless of their location. Apart from the traditional video/audio physician encounter, telehealth can provide educational tools on everything from medical conditions to social determinants of health. AIP, on the other hand, is focused on helping individuals 65+ age in their home as independently as possible.

- This telehealth infusion is driven by increased patient and provider adoption, better reimbursements, and relaxed regulations. Although adoption may slow after COVID, telehealth benefits are recognized and are here to stay.

How big is the T4W opportunity?

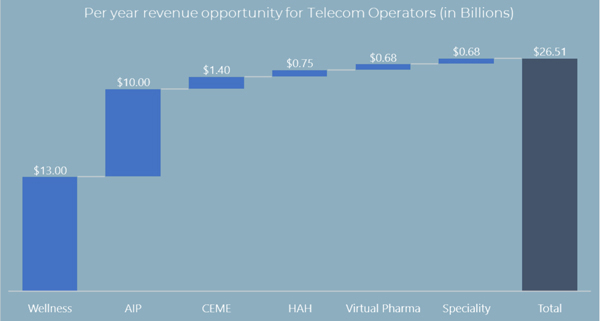

In the report [6], we analyze different services which are driving wellness costs that can be addressed by T4W initiatives. These services include Perpetual Wellness, AIP, Communication-Enabled Medical Encounters (CEME), Virtual Pharmacy, Hospital at Home, and Remote Specialty Services. A very conservative analysis of these six segments shows, as illustrated in Figure 3, that a telecom operator in the US can recognize ~$27 billion per year. Note that telehealth is a mechanism that enables remote communication in AIP, CEME, HAH, Virtual Pharma, and specialty opportunities. The factors that affect the opportunity for telecom operators depend on the value of the application space for the consumers and the value that a telecom operator brings to each use case. In our working groups [4], [5] we analyzed how cable operators can add value to the wellness industry for AIP and telehealth opportunities. Telecom operators can underestimate their potential value to the wellness industry. Here’s a brief list of common telecom core differentiators to consider:

- The existing telecom subscriber base and the households passed are major assets.

- Home networking is notoriously challenging and critical to the success of any new service. The ability to ultimately provide installation and service support with a truck roll has tremendous value.

- Carrier-grade redundancy of data and content infrastructure can be leveraged for critical functions and on-demand services that can surge for seasons and unexpected events.

- Telecom players have various types of billing relationships with their customers such as monthly billing per service, equipment rental, etc. Transaction-based billing and record-keeping could be crucial to support evolving healthcare payment models. Service bundling is another valuable capability for expanding the reach of infrequently used services.

- Telecom operators have invested significantly in their analytical infrastructure to monitor customer services. These can be easily extended to solve the critical problems in T4W initiatives.

For developing a strategy for stronger participation in virtualized wellness economy, telecom platforms are table stakes for every use case developed in [6]. The challenge is developing a strategy to strengthen the role of telecom companies beyond bandwidth and access. Leveraging core competencies around service and support, billings and hosting infrastructure, and marketing of services are important to consider when looking at building a substantial healthcare revenue stream.

What is SCTE doing about it?

SCTE, a subsidiary of CableLabs, is an ANSI-accredited standards-developing organization (SDO). Founded in 1995, the SCTE Standards Program’s original and continuing scope is to create standards and operating practices dedicated to supporting the cable industry’s networks.

In March 2020, the Standards Program embarked in a new direction, launching the Explorer initiative. In addition to covering the network layer, the Explorer mission is to investigate how best to offer compelling and interactive services over cable networks. The Explorer Initiative is helping to usher in a new era of service connectivity for our customers.

The strength of the Standards Program is that it fosters open information sharing and collaboration between network operators and vendor partners. With the Explorer initiative, this ecosystem of collaboration has expanded to include service developers and service users. Through collaboration, subject matter experts from across industries develop standards and best practices that will capitalize on the capabilities of the cable industry’s 10G Platform.

Each working group meets to discuss challenges and opportunities their specific industries face relative to telecommunications. With one-hour meetings, the time commitment is minimal, but the impact is colossal. By raising issues, voicing opinions, and speaking from experience, groups create industry standards and share insights. Each group covers specific topics and pursues unique goals while sharing their progress with the initiative participants. With over 1,100 Standards Program participants, representing over 130 companies, the reach of the Standards Program is immense and impactful. SCTE has vast experience facilitating working groups in a wide range of technological fields such as alternate energy, HDR video, smart amplifiers, and the generic access platform.

One of the standard working groups in the original Explorer 2020 launch was Aging in Place & Telemedicine. In the two years since its inception, the working group has provided a forum for network operators, vendor partners, medical service developers, and medical service users such as doctors and hospitals, to exchange ideas and document plans and operational practices so that new services can smoothly scale and be offered to millions of customers over cable access networks. Where else can people meet that will include the cross-industry key decision makers within the network operators, service providers, and end users? The net objective of these activities is to create a better, integrated service experience for both providers and users. With the Aging in Place & Telemedicine working group, the unique requirements of offering these services are explored and carefully planned.

What’s next?

This article is the first in a series of four articles that the SCTE DSS working groups 3 and 4 plan to present in Broadband Library. In upcoming articles, we will discuss market landscape, architectural requirements and solutions. For more detailed discussions, we recommend visiting https://www.scte.org/information-page-index/scte-explorer/ or reaching out to the authors of this article.

Figure 3. A conservative estimate of US T4W opportunity size by DTS.

References

- DTS strategy team, Cable operator cost center versus revenue center discussions, DTS blog, available here: https://duketechsolutions.com/mso-cost-vs-revenue-discussion/.

- Sudheer Dharanikota, Smarter bandwidth pipes “The NextGen revenue opportunities”, DTS blog, available here: https://duketechsolutions.com/smarter-bandwidth-pipes-the-nextgen-revenue-opportunities/.

- Sudheer Dharanikota, Luc Absillis, Mario Di Dio, “Step By Step Methodology For Optimal Access Transformation Planning,” SCTE Journal, June 2022, available here: https://duketechsolutions.com/wp-content/uploads/2022/10/2022-2Q-Step-By-Step-Access-Transformation-Methodology.pdf.

- Data Standards Subcommittee, Working Group 3, Aging in Place, available here: https://wagtail-prod-storage.s3.amazonaws.com/documents/SCTE26421_Standards2022_AgingInPlace_Flyer_20220818_Print.pdf.

- Data Standards Subcommittee, Working Group 4, Telemedicine, available here: https://wagtail-prod-storage.s3.amazonaws.com/documents/SCTE26421_Standards2022_AgingInPlace_Flyer_20220818_Print.pdf.

- DTS strategy team, Telehealth market report – A telecom-based opportunity analysis, DTS market report, available here: https://duketechsolutions.com/telehealth-market-report/.

- DSS 164: Cable Operator’s Aging in Place and Telehealth Opportunity, available here: https://www.scte.org/information-page-index/scte-explorer/.

- AIP and Telehealth business cases for cable operators, DTS T4W team, available here: https://duketechsolutions.com/telecom-for-healthcare/.

Chris Bastian,

SVP/CTO, Engineering,

SCTE® a subsidiary of CableLabs®

Chris Bastian is Senior Vice President and Chief Technology Innovation Officer for the Society of Cable Telecommunications Engineers (SCTE®), a subsidiary of CableLabss. With three decades of leadership in advanced cable and network security technologies, Chris is responsible for all areas of technology and engineering to ensure that SCTE maintains a leadership role in standardizing and operationalizing advanced technology, including the SCTE Standards Program and the SCTE Engineering Committee – as well as groundbreaking efforts such as SCTE’s Energy 20/20 program.

Dr. Sudheer Dharanikota,

Dr. Sudheer Dharanikota,

Managing Director,

Duke Tech Solutions,

CEO of First Principles Innovations

Sudheer has more than 25 years of experience in the telecommunications industry as a strategist, product line manager, architect, development lead, and standards contributor. He is known for his strategic, technological, and product execution activities in access network technologies and services. As a managing director at DTS, he has been working on access transformation strategies and new technology introduction strategies for large cable operators. He is responsible for driving the strategic guidelines, technology decisions, budgetary-need analysis, and roadmap decisions for cable operators. He is the chairman of the SCTE Aging in Place and Telehealth working groups that focus on the Telecom for Wellness initiatives. Sudheer earned his MS in electrical engineering from the Indian Institute of Science, a Ph.D. in computer science from Old Dominion University, and an Executive MBA from Duke University.

Source: Figures provided by authors

Shutterstock