CBRS: A Spectrum Policy Experiment — Cable is Best Positioned to Benefit

By Rajat Ghai

The skinny

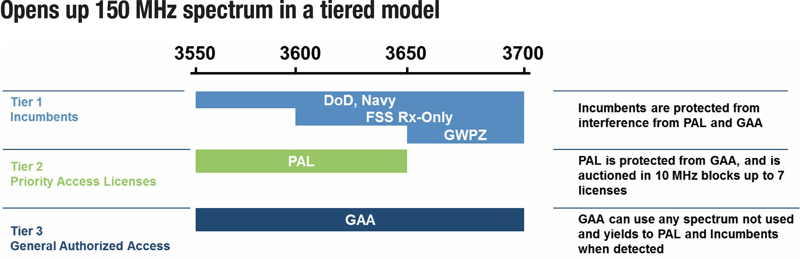

In the first of its kind spectrum policy experiment by the FCC, Citizens Broadband Radio Service (CBRS), also commonly known as the innovation band, is a 150 MHz-wide shared spectrum in the 3.55 GHz to 3.7 GHz band. FCC spectrum sharing policy creates an innovative way for a lightly licensed tiered access that supports dynamic sharing of spectrum in real time. As a one of its kind spectrum sharing concept, CBRS aims to combine the best of traditional licensed spectrum (LTE) and unlicensed spectrum (Wi-Fi) by combining the best of both technologies.

Specifically, for cable operators, the CBRS band offers them a path to deploying their own LTE network without making significant investments for licensed spectrum acquisition.

Operators can thus strategically utilize CBRS for diverse use cases described in this article that will position them very favorably to leverage the economics of the FCC’s CBRS initiative to deploy mobile infrastructure very cost effectively.

1 — Introduction

In 2015, the U.S. Federal Communications Commission established the CBRS for a one of its kind and the first ever, shared wireless broadband use of the 3350 MHz to 3700 MHz band (also referred to as 3.5 GHz Band).

FCC rightly calls it the “innovation band” as cited by them as the intent of this shared spectrum principle:

“The Citizens Broadband Radio Service takes advantage of advances in technology and spectrum policy to dissolve age-old regulatory divisions between commercial and federal users, exclusive and non-exclusive authorizations, and private and carrier networks.”

2 — CBRS use cases for cable operators

The FCC’s choice of (first ever) spectrum policy innovation, through creation of shared spectrum rules for CBRS, significantly lowers the barriers to entry for non-traditional wireless carriers. The flexible three-tier licensing framework lowers the barrier to spectrum and promotes success-based investment for new entrants. Due to significantly lower cost of PALs compared to exclusive use licensed spectrum costs, the FCC has leveled the playing field by democratizing LTE networks.

Operators specifically stand to gain substantially from this CBRS initiative, with some of the use-cases described here:

2.1 — Inside-out: localized indoor mobile access (LIMA)

Statistics state that an average of 80-90% of mobile sessions happen indoors. Operators can employ a novel inside-out strategy where they can build a massive LTE network by initially focusing on advanced wireless LTE solutions inside the residence and enterprise, and eventually expanding outdoors (hence inside-out). Such an inside-out strategy leverages deployment of indoor CBRS small cell radio in the home or business.

Since indoor mobile networks cover a majority of the mobile sessions on the indoor network, the rest of the mobile sessions, originated by their subscribers outdoor ‘on the go’ may be offloaded to the MVNO partner’s MNO network.

Reduced CBRS shared spectrum acquisition cost along with an inside-out enables operators to launch a near ubiquitous market-wide LTE network at a fraction of the cost of a traditional macro cellular network AND at a fraction of the cost of being a pure MVNO. This can lead to an enablement of very competitive mobile service offerings to compete with the traditional Tier 1 cellular operators and create a profitable and sustainable mobile wireless business for the cable operator.

Figure 1. CBRS Spectrum TiersFigure 1. CBRS Spectrum Tiers

Figure 1. CBRS Spectrum Tiers

2.1.1 — Inside-out mobile access economics

While an MVNO based mobile service gets cable operators into the mobile business quickly, the MVNO terms were negotiated years ago, with certain fixed costs between $5 to $10/GB, and it’s likely that the MNO host operator would not be eager to give better MVNO deals anytime soon due to competitive reasons. With an average mobile data usage of approx. 11.9 GB/month, a pure MVNO deal would require the operator paying close to $95/month per mobile device to their MNO host. Clearly, such a business model is not sustainable in the long run if the unlimited plan subscriber (majority of the subscribers) only pays $45/month.

However, with CBRS/shared spectrum, an innovative inside-out strategy coupled with opportunistic cable Wi-Fi offload and a modest outdoor CBRS/LTE network in strategic densely populated areas (hot zones), the cable operator can minimize the amount of wireless traffic that flows over the MNO host cellular network. This is the inflection point that creates a very powerful competitive advantage.

Since 80% – 90% of the wireless sessions originate indoors, it is highly likely that a network planned around inside-out strategy could reach a traffic distribution pattern that, for a typical user, might look like the following:

• 50% of the monthly LTE data on a cable operator-owned indoor CBRS/LTE network based on LTE enabled cable gateways; i.e., 5.95 GB/month/device

• 20% of the monthly LTE data on the cable operator-owned outdoor CBRS/LTE network based on LTE small cells at their outdoor fiber optical nodes of their fiber deep HFC plant; i.e., 2.38 GB/month/device

• 10% of the monthly LTE data strategically offloaded to the cable Wi-Fi network; i.e., 1.19 GB/month/device.

• Rest, 20% of the monthly LTE traffic would use the MNO host’s macro LTE network; i.e., 2.38 GB/month/device

For such a monthly traffic profile, the cable operator can provide a profitable wireless service at a cost of $22.25/month/device, which leads to a sustainable business since such a network costs only 1/4th of $95/month/device associated with a “pure” MVNO business model.

2.2 — Outdoor mobile access

Cable operators have invested in fiber deep (HFC plant) successfully for the last 20 years to support high speed broadband access to their subscribers. Operators can now leverage the dense HFC plant in general, and the fiber nodes in particular, to strategically install outdoor CBRS/LTE metro cells to further densify mobile access (beyond indoor densification using the inside-out strategy).

Leveraging HFC/fiber nodes to provide outdoor CBRS/LTE mobile coverage is a great option for operators to build out an LTE network and make the MVNO economics work in their favor. Since an MVNO pays a mobile operator for traffic going over the host operator’s network, higher subscriber usage directly translates to higher network cost. Hence, for cable operators, this means offloading subscriber traffic over to owned networks as much as possible.

2.3 — Neutral host networks and private LTE networks

Large enterprises have traditionally deployed Wi-Fi networks to satisfy the growing wireless data demand. However, it has been a poor substitute for critical mobile wireless internet or seamless mobile voice services indoors. The FCC has democratized LTE by making CBRS/LTE a shared spectrum as opposed to exclusive use licensed spectrum that Tier 1 operators use. Like Wi-Fi access points, enterprises and venues can run seamless LTE services and create a private LTE network, in a similar manner as Wi-Fi, to run enterprise- or venue-specific applications on mobile devices of consumers or workers, enabling tremendous flexibility.

Similarly, large public venues such as stadiums and airports, high-rise buildings, large hospitals, and university campuses are ripe for a new breed for a CBRS based neutral host providers to address a growing, pent-up demand for in-building wireless coverage and capacity expansion.

Cable operators can create new revenue streams by creating turnkey private LTE solutions for enterprises.

2.4 — Industrial IoT networks

As the FCC democratizes LTE in the 3.5 GHz (CBRS) band, it also paves the way for using private LTE for mission/business critical industrial IoT applications. Unlike licensed spectrum based IoT that is operated and managed by the cellular operators, CBRS based industrial IoT networks are owned by the enterprise, managed locally, using dedicated network LTE RAN that can be optimized for the specific industrial process.

2.5 — Fixed wireless access

CBRS allows operators to augment their cable HSD plant with opportunistic fixed broadband service where the cable or fiber service may not be possible due to business contracts or if doing civil works (digging and trenching) is cost prohibitive.

Conclusion

The shared spectrum model is a first of its kind innovative dynamic, three-tiered, shared spectrum approach adopted by the FCC for the Citizens Broadband Radio Service. It is a bold and historic shift in spectrum allocation that hopes to combine the best of unlicensed and licensed technologies together. Developing and deploying an effective spectrum sharing mechanism through CBRS would be a significant achievement. It is an exciting opportunity because it makes available a significant amount of spectrum without the need for expensive auctions and is not tied to a particular operator.

Rajat Ghai

Rajat Ghai

VP Wireless & Open Networking, Technicolor

As VP of wireless and open networking, Rajat supports the CTO office at Technicolor’s Connected Home division to refine the company’s technology vision and direction. Prior to Technicolor Rajat held the role of CTO at Benu Networks where he was responsible for driving technology strategy. With over 29 years of service provider IP mobility and telecommunication technology experience and having founded two wireless networking startups, Rajat brings a unique vision for evolving service provider’s networks and services.